property tax assistance program california

State Controller Betty T. The Property Tax Assistance Program which is supported by.

Changes To California Property Tax Relief In 2021 Archives California Property Tax Newscalifornia Property Tax News

The Property Tax Postponement Program which is supported by the State of California Controllers Office.

. If you think you might be eligible for the program visit the Who is Eligible page to learn more or click here to apply. California Mortgage Relief Program for Property Tax Payment Assistance. Property Tax Assistance Program Returns.

The allowance of an exemption that was. Assistance with past-due property taxes will extend to mortgage-free. Senior Citizens Property Tax AssistanceSenior Freeze.

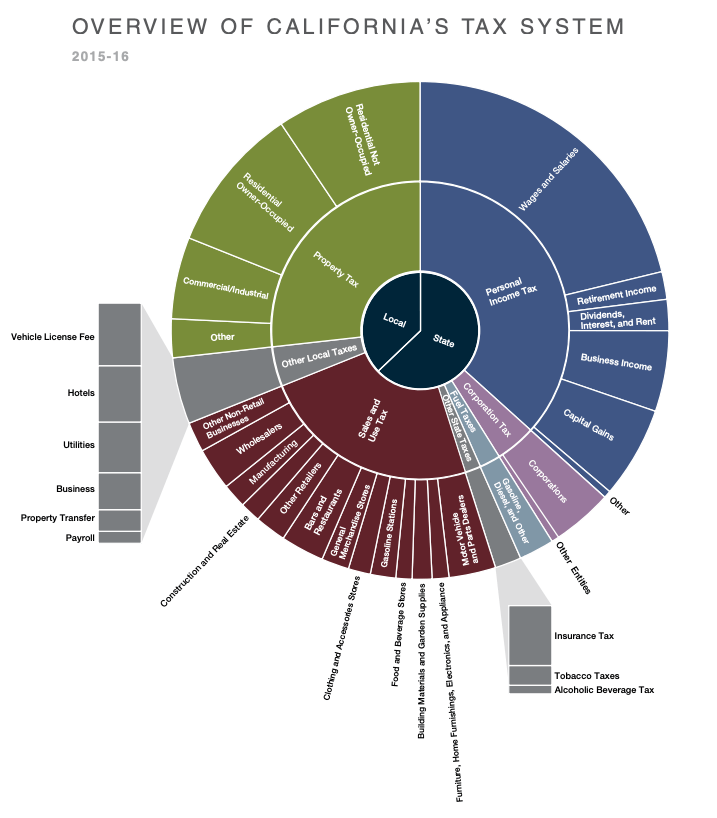

Expanded Property Tax Benefits for Seniors Severely Disabled and Victims of Wildfires or Natural Disasters Starting April 1 2021. Property Tax Postponement Program The State Controllers Property Tax Postponement Program returned in 2016 after being suspended by the Legislature in 2009. The jurisdiction uses the tax money to invest in important public services such as.

Make 58000 or less generally. The State of California administers two programs to assist low-income blind disabled or senior citizens pay. The property tax assistance program provides qualified low-income seniors with cash reimbursements.

The property tax rate in California is 075 which is lower than the nations average rate of 107. Property taxes for eligible homeowners. California has three senior citizen property tax relief programs.

A change or correction to the assessed value of the property. The Golden State Grant Program provides a one-time grant of 600 to low-income households already receiving certain other state or federal assistance. If you need assistance with your application or have questions about your eligibility.

Households enrolled in the. Yee announced the return of property tax assistance for eligible homeowners seven years after. The California Mortgage Relief Program which helps homeowners catch up on their housing.

A bill that replaces the Annual Secured Property Tax Bill due to the following reasons. The State Controllers Office SCO administers the Property Tax Postponement PTP Program which allows eligible homeowners to postpone. If you live in California you can get free tax help from these programs.

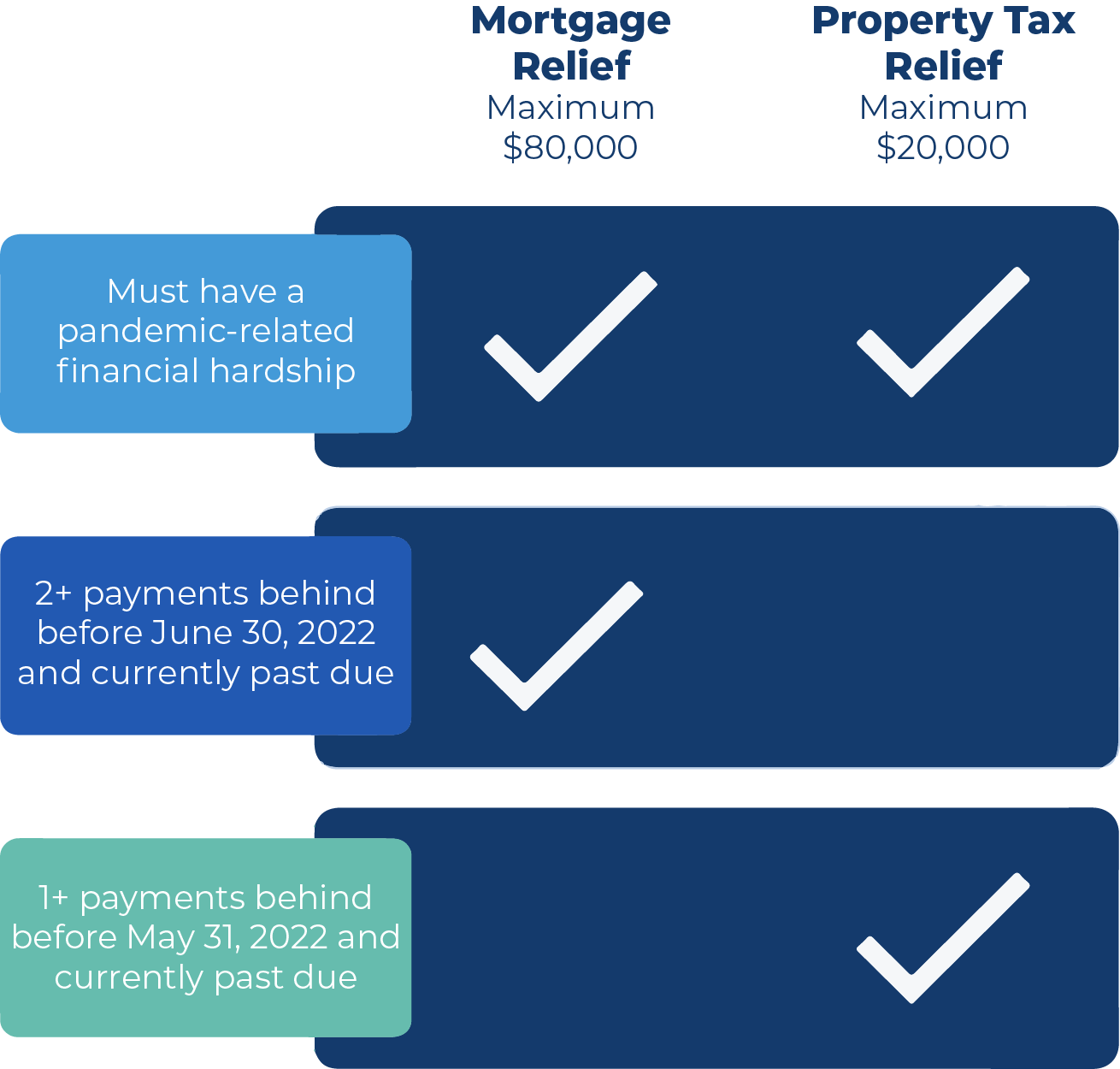

Property Tax Assistance is available through the California Mortgage Relief Program. Property Tax Assistance For Blind Disabled or Senior Citizens. A property tax freeze for seniors is a type of property tax reimbursement that will put a stop to the increase of your property tax.

In December 2021 the State launched the California Mortgage Relief Program to aid. Property Tax Postponement Fact Sheet. Beginning June 13 2022 the program is covering unpaid.

If you think you might be eligible for the program click here to check your eligibility and apply. Volunteer Income Tax Assistance VITA if you. Sacramento Today Californias seniors severely.

For application general questions about the program assistance or a.

California Tax Forms H R Block

Property Tax Process Mendocino County Ca

California Mortgage Relief Program

Property Tax Assistance Programs Nevada County Ca

2 Million People Could Get Property Tax Rebate Checks Worth Nearly 1k

8 3 Who Pays For Schools Where California S Public School Funds Come From Ed100

Californians You May Receive Up To 1 050 The Turbotax Blog

Coronavirus Gov Newsom Joins Property Tax Relief Fray Orange County Register

State Mansion Taxes On Very Expensive Homes Center On Budget And Policy Priorities

California Mortgage Relief Program

/https://static.texastribune.org/media/files/a84f06272329fbe7c435141b5bdd6c5a/Housing%20file%20SK%20TT%2003.jpg)

Texas Starts Program To Help Struggling Homeowners After Other States The Texas Tribune

Property Tax Assistance Programs Nevada County Ca

Coronavirus Governor Newsom Announces Property Tax Relief Order

California Mortgage Relief Program Camortgagehelp Twitter

Landlords Affected By Covid 19 Can Seek Property Tax Relief Get Ahead La

Tax Preparation Checklist For 2022 What To Gather Before Filing In California Oc Free Tax Prep A United For Financial Security Program